cash ratio

De cashflow ratio of kasstroombenadering is een variant van de interest-coverage ratio. The cash ratio is derived by adding a companys total reserves of cash and near-cash securities and dividing that sum by.

Cash Ratio Knowledge Center And Forum 12manage

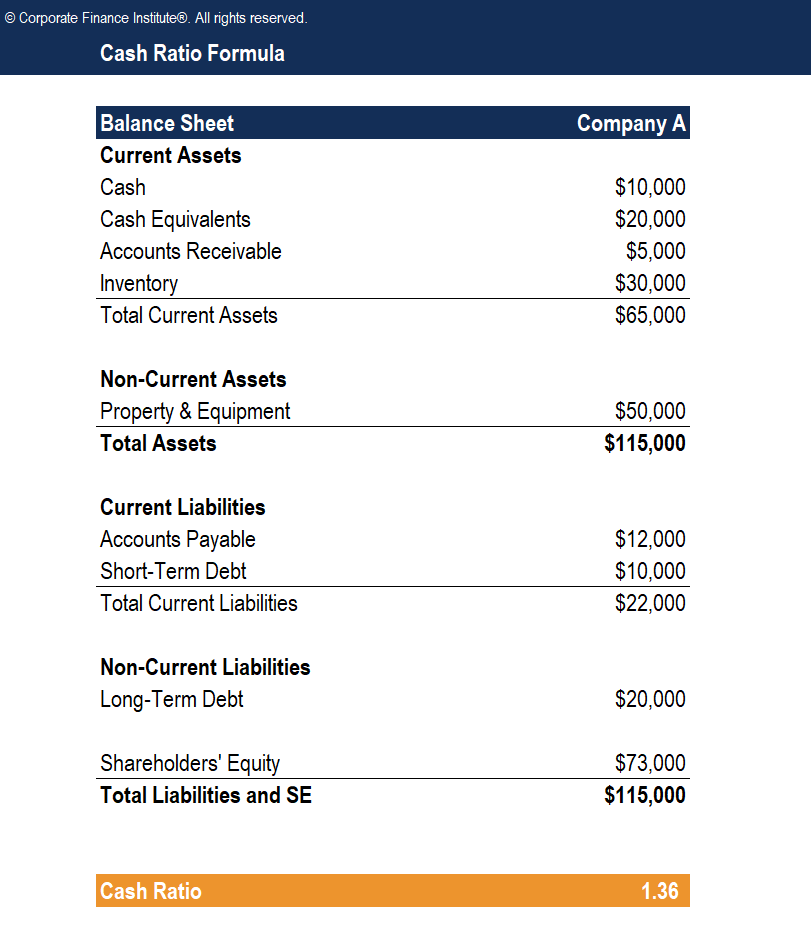

The cash ratio is a financial ratio to measure a companys ability to meet its short-term liabilities.

. 1973 Oosthoek Encyclopedie Nederlandse encyclopedie Cash ratio. Cash and cash equivalents Current Liabilities. Hoe hoger de uitkomst van deze ratio des te eenvoudiger de onderneming aan haar verplichtingen aan de verschaffers van het lang vreemd vermogen kan voldoen.

Understanding the Price to Cash Flow Ratio. Maak uw werk gemakkelijker met modelbrieven rekentools checklists en stappenplannen. De cash ratio geeft aan hoe snel een organisatie haar schulden op korte termijn kan terugbetalen.

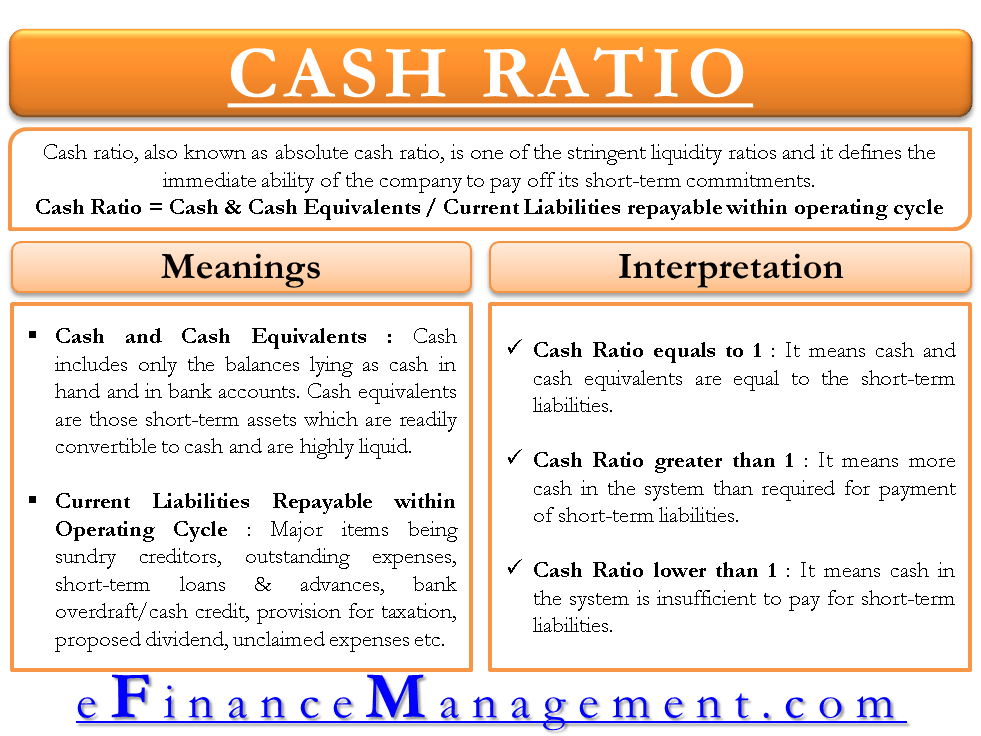

The metric calculates the ability of a company to repay its short-term debt with cash or near-cash resources such as securities which are easily marketable. The cash ratio or cash coverage ratio is a liquidity ratio that measures a firms ability to pay off its current liabilities with only cash and cash equivalents. Key Takeaways The cash ratio is a liquidity measure that shows a companys ability to cover its short-term obligations using only cash.

It is a fundamental financial management tool. Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current liabilities. Treasury bills short-term government bonds.

Ad Meld u gratis aan en bespaar tijd geld én moeite met direct toepasbare tools. More about cash ratio. Liquid assets included in the cash ratio are the companys cash available and assets that the company can convert to cash easily.

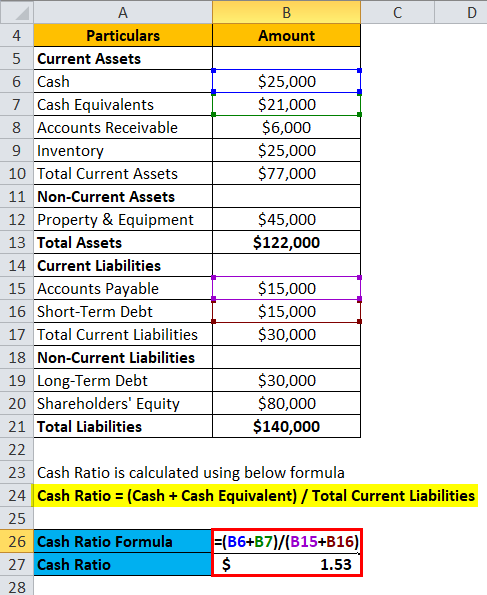

Meaning of Cash Ratio The cash ratio is a measure of the liquidity of a firm namely the ratio of the total assets and cash equivalents of a firm to its current liabilities. Een sterke cash ratio is bijvoorbeeld nuttig voor schuldeisers om te bepalen hoeveel schuld er op korte termijn kan worden terugbetaald vanuit de organisatie. Cash Cash Equivalents in the Numerator Short-Term Liabilities in the Denominator Cash Ratio Formula Cash Ratio Cash Cash Equivalents.

Bij banken de verhouding tussen direct opvraagbare gelden en depositos. De cash ratio of cash coverage ratio is een liquiditeitsratio die het vermogen van een onderneming meet om haar kortlopende verplichtingen af te lossen met alleen geldmiddelen en kasequivalenten. The cash ratio is more conservative.

The cash ratio is liquidity ratio that measures the ability of a company to pay its liabilities with cash. What is Cash Ratio. The cash ratio is calculated by adding the value of cash and other marketable securities and then dividing by any liabilities.

The cash ratio formula consists of. Or manually enter accounting data for industry benchmarking Cash Ratio - breakdown by industry Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current liabilities. De cash ratio is een rekenformule en indicator van de liquiditeit het totaal van middelen van een organisatie.

The cash ratio also known as the cash coverage ratio is a measurement of how well can the company pay its short-term debt in the form of cash and cash equivalent investment items that immediately available to be turned into cash eg. Maak uw werk gemakkelijker met modelbrieven rekentools checklists en stappenplannen. The cash ratio is one of three common methods to evaluate a companys liquidityits ability to pay off its short-term debt.

Cash ratio cash ratio - Het verhoudingsgetal van liquide middelen en de vlottende activa van een bedrijf. The cash ratio is a measure of short-term liquidity similar to the current ratio and quick ratio. It measures the efficient utilization of a.

In financial ratio analysis cash ratio is a conservative measure of a firms liquidity. Cash ratio also called cash asset ratio is the ratio of a companys cash and cash equivalent assets to its total liabilities. It is the most conservative ratio in measuring liquidity compared to the current ratio or quick ratio.

For instance if a company is in high-growth mode and is rapidly gaining market share then it may be burning through its cash and is experiencing negative cash flows. Cash Ratio Formula Cash ratio is computed using the following formula. What is the Cash Ratio.

The cash flow on total assets ratio is an efficiency ratio that measures a companys performance from core operations with consideration to its assets. There are several issues to consider as part of this analysis. It is the most conservative of the three methods.

The cash ratio is a comparison of a companys cash and cash equivalents known as the companys liquid assets to its immediate debts. Ad Meld u gratis aan en bespaar tijd geld én moeite met direct toepasbare tools. The cash ratio is much more restrictive than the current ratio or quick ratio because no other current assets can be used.

Cash ratio is not given much importance unless a firm is in deep financial trouble but cash availability provides a guarantee for payment of debt. It is more conservative compared to the current ratio and quick ratio since only cash and marketable securities are compared with current liabilities. The ratio is used to determine whether a business can meet its short-term obligations - in effect whether it has sufficient liquidity to stay in business.

The cash ratio compares a companys most liquid assets to its current liabilities.

Cash Ratio Formula Meaning Example And Interpretation

Formula Of Cash Ratio Project Management Small Business Guide

Cash Ratio Definition Formula How To Interpret

Cash Ratio Formula Definition And Ananlysis With Examples

0 Response to "cash ratio"

Post a Comment